- First of all, economy is supposed to go up and down, that's how money is made on the market. A psychology behind spending money always stays the same. In 2008 when the financial crisis began, no one cared about spending money on self-actualization aka luxurious items, everyone understood the true value of money. Now, 4 years later, people start spending, stocks starting to climb, earnings recovering. People started to lose their conservativeness. But, as the book "Rich dad, poor dad" pointed out : "The stock prices are too high, when cab drivers start talking about the market." That is a good and simple indicator. Don't spend your time in a cab tweeting. I advise talking to the driver, see what he knows.

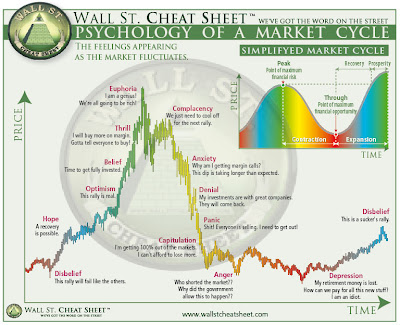

- Secondly, about a year ago I found a perfect chart describing the macro economy. Bigger picture : http://steadfastfinances.com/blog/wp-content/uploads/2010/06/Psychology-of-Market-Cycles-via-Wall-Street-Cheat-Sheet.jpg

Now I suppose we're at the beginning of the blue. How? Everybody is speaking about the crisis in Europe, especially Greece, Portugal, Spain and Italy. But first, they're quite a little part of the world, and secondly, I believe that they will overcome this. This is why the EU was created, to stabilize the economical situation of different countries, which in this case are neighbors by the location. I believe, Greece will have its huge bailout from their debt, Italy has already overcome theirs and I also think Spain and Portugal should take Argentina's example and default, that would be smart thing to do. But that would be a little too extreme and probably won't happen. Moreover : http://www.slate.com/articles/business/moneybox/2012/05/spain_greece_and_portugal_should_quit_the_euro_it_s_the_only_way_to_save_their_doomed_economies_.html

- All in all, the market is supposed to go up and down and the news surrounding it is simpy the noise. But hey, guess that's why the 10% get it right every time and the rest 90% always lose money betting on the market too late. The reason economy will not crash in the moment is that we are ready for it. Before the 2008, most of us didn't expect any crisis to come, because we were literally living in a bubble. Also, I think it might be happening even faster and faster in the following years, because that's how the trend has been so far. It's not impossible that the green peak might be coming already in 2015.

Now, a few words about the future developments. Well, two months ago I learnt about something interesting concerning the energy market in the next decade. More precisely, alternative (green) energy.

- 15 years ago, the first electric cars, that could actually hit the market someday, were introduced. The biggest shareholder on the energy market, Exxon Mobile, bought the license. Now, license applies for 20 years. That means, 5 years from now the per cent of electric cars on the market will rise quickly, because other companies will have unlimited right to sell those. Sure, Exxon has loosened the strap, so the first lithium-ion battery EVs (electric vehicle) could enter the market. Probably Exxon wants to see, how the market reacts to the high price of EVs. That's why all the EVs right now, have a simple lithium-ion battery, which makes it expensive. In the future, the battery technology will develop fast, because already now there has been invented nano batteries, which are able to contain much more energy than usual lithium-ion batteries. I found a simple paragraph comparing the lithium-ion and Carbon Nanotube (one of the many possibilities of nano batteries) :

- The major difference comes from a typical lead acid battery providing 12-15 kW-hours of electricity or a range of 50–100 miles, where the CNT lead/lead-acid battery will deliver 380 miles distance between charges. This battery could also be recharged in under 10 minutes. The typical lead-acid battery has a recharge time between 4 and 10 hours

- This is a huge step and probably there's more coming in 5 years. That's why I would recommend investing in hybrid car or electric car manufacturer. For example, Nissan, Mitsubishi, Opel, Tesla. Or, though more risky, invest in the battery companies and there's a possibility for them to grow dozens of times. But there's a pretty huge risk involved, because they have decreased rapidly during the crisis. For example : Altair Nanotechnologies, A123 Systems.

Now let's get to my investments this week :

ALXA -2% the pharmaceutical company that had decreased 14% and then had good news about the FDA approval on their new drug. Still hadn't been making its growth, but I think increase will come because it has a rising trend with a certain main-line and channel-line.

ALXA 1-year history

KIM -1.1% still has the trendlines, basically same chart as last week, between the trendlines. Waiting for a 2-pt aka 10% rise in next 2 weeks. If won't happen then I'll just "sell the fucker" so to speak.

L -3.2% same thing as KIM.

They're both waiting for the fiscal cliff accouncement. It means the US. government will decide how much the wages and the taxes are going to change in order to improve the macroeconomy. The Republicans and Democrats will find the compromise by the end of this weekend, but good news is that president Obama has softened his conditions so the 'cliff won't be that rapid'. The whole market movement on the new year's first couple days depend on that. Moreover : http://www.huffingtonpost.com/2012/11/09/obama-fiscal-cliff-speech_n_2102168.html

Next : I'm going to buy Wellpoint (WLP) - I like its P/E of 7.94, which means it's underrated by the market. Also I like it's fluctuating price. I just might wait a little bit, so also the triple bottom would be complete, because so far it has been working well for me, so there's no reason not to trust that. Also MACD is should rather be crossing zero-point before the rise not be on the top.

WLP 1-year chart

More about technical analysis next week!

Happy new year.